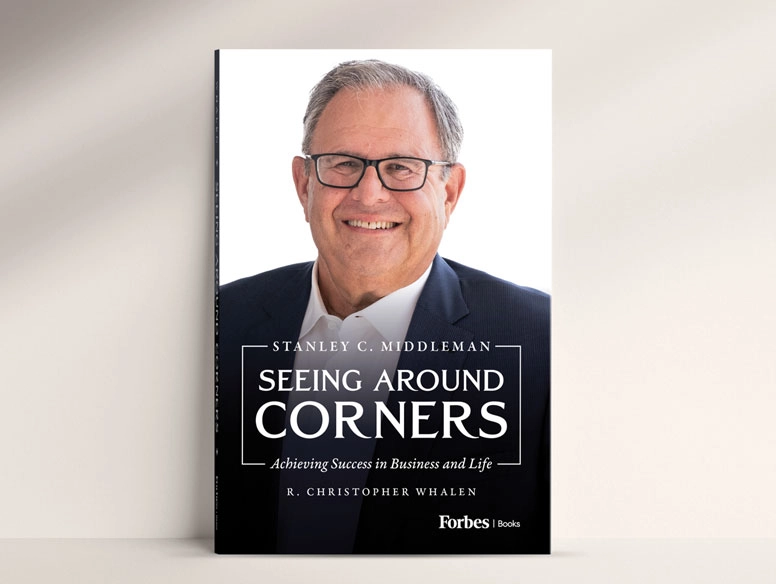

Seeing Around the Corner with Stanley Middleman

My Life’s Journey: Seeing Around Corners

I'm pleased to share that my life's journey will soon be available in a book called, “Seeing Around Corners”

Professional Curiosity

If you wish to grow in your career, it is important to demonstrate professional curiosity.

Preparation Is Key to Success

If you don't plan to succeed, you plan to fail! This is a simple truth.

Reach Higher

Happy New Year! Welcome to 2024!

Thank you!

As the year wraps up, this is the perfect time to thank those in our lives for their help, guidance, or collaboration

Focus on What Matters

What have you accomplished and what do you plan to complete before the end of the year?

Do You Know Yourself?

What are your strengths and weaknesses at work?

Are You Motivated?

You can start anything at any point in time, you just need to take action.

Importance of Being a Lifelong Learner

In order to achieve your goals, you have to always push yourself to learn.

Make Your Dreams Come True

Dream your dream. We all have dreams, but not many do the work to make them come true.

Balance Is Key

While it is important to hit your goals, it's necessary to balance our work and personal lives.

Choices and Decisions

Throughout our lives we face many challenges and make innumerable decisions and choices.

Are You Achieving Your Goals?

How does one achieve? It starts with you. If you don’t believe in you, who will?

Be Your Best in 2023

Personally, heading into a new year always has two fundamental components.

Happy Holidays!

How lucky are we to live as we do in a world that allows us to sleep in a warm bed with a full stomach and a clear mind?

It’s Time to Slow Down a Bit and Give Back

Often, we are too busy with our own personal goals and priorities that we may miss what could turn out to be an important event.

Outlook: Sunny with a Hint of Inflation

Right now, there’s a lot going on in the world—war, disease, economic issues abound, social unrest. So, what is sunny?

It's Time to Reassess and Start Planning for 2023

Now is the perfect time to refocus and begin driving towards your year-end goals

Obtaining your goals

Outcomes being pursued can vary widely depending on the individual and each demand their own tactics.

Leaders built our country

Optimism is as normal as the buds on the trees. Hope and energy pervade the air. We are ready to go.

Have a nice summer!

As we head into summer and host barbecues in our backyards, get away to beaches, and reunite with family and friends, let’s remember to give thanks.

Appreciate each moment

It’s a special treat to see the joy and satisfaction of our accomplishments.

It’s Spring!

Optimism is as normal as the buds on the trees. Hope and energy pervade the air. We are ready to go.

In times of change, don’t be afraid to seize opportunities

Interest rates have been fluctuating and it’s definitely higher than a mere few months ago.

Finding momentum when the going gets cold and bleak

During these dreary days, it can be enticing to hunker down and embrace the bleakness, and just wait for spring to arrive.

Setting goals for the coming year

I hope each of our hopes and dreams come true. One way we do this is through things like setting New Year resolutions.

Get ready for 2022

We emerged from being locked down with a new appreciation for our personal freedom and the value of reconnecting with family and friends in person.

Honoring our veterans

November is a special month for me and for all of us at Freedom Mortgage. It’s not simply a day, but an opportunity to honor veterans throughout the month.

A home can help you build your wealth

Consistently since last year and into this year, we have seen home values go up as inventory continues to be at record lows.

4 Keys to building endurance

It’s back-to-school season and many children across the nation are already in class while others are getting ready to start the school year.

Never stop learning

It’s back-to-school season and many children across the nation are already in class while others are getting ready to start the school year.

The importance of giving praise and recognition

This is truly a wonderful time because our country is returning to normal, finally.

Advice for everyone (especially recent graduates)

After more than a year of uncertainty, social distancing and confinement to our homes, it’s nice to go out and see streets filled with people again.

We support those who protect our freedoms

May is Military Appreciation Month and here at Freedom Mortgage supporting the military, especially veterans, is something we do every day because it’s a part of our DNA.

Be your own extraordinary force

The way I see it, no one really likes change. However, we all have the power to improve the way we perceive the very nature of change.

Resilience

I've heard a lot of talk about resilience in the sphere of business - especially after the tough year we had in 2020.

Nurturing top talent and keeping it on your team

Personally, I think that successful teams are built by the combination of strong leadership and talented members.

The Zoom Room - the new boardroom

Last year’s circumstances initiated massive reforms to business as usual. As a result of the coronavirus pandemic, business models from all over the world were disrupted.

Leading with the Golden Rule in mind

Change is the basis of each of our lives. However, many people fear change and avoid it at all costs.

Embracing change

Whether we like it or not, change is always around the corner. Change is the basis of each of our lives.

Coming home for the holidays

The warmth and anticipation that comes along with the holiday spirit is priceless. Families, friends, and loved ones gathering, celebrating each other, and counting blessings...personally, I can't think of anything more magical.

Showing our gratitude by serving our heroes

I look around and see blessings that are ours due to our Veterans – their impact is crystal clear on Veteran’s Day.

The decision to grow: the moment of go

I've been asked how I knew when it was time to invest in order to be in a position to grow, perhaps because many other companies were not able to handle the demands that the market presented this year.

30 years of offering 30 year mortgages

You learn a lot when you build a mortgage business and lead a team over thirty years of mortgage ups and downs.